SIX NATIONS — The Haudenosaunee Development Institute/2438543 Ontario Inc. has spent nearly $10 million purchasing property in the province of Ontario and paying provincial and municipal taxes on those properties.

Records obtained by 2RT show a minimum of $177,000 in provincial and municipal land transfer taxes have been paid by HDI/2438543 Ontario Inc. since 2015 — directly contradicting a 2006 declaration made by the Haudenosaunee Confederacy Chiefs Council — vowing they would never pay taxes on their own land.

The most recent of those tax payments totalled $48,219 and was paid to both the city of Toronto and the province of Ontario upon the $1,380,000 purchase of the 38 Howard Park condo — a 3-bedroom, 4-bath walk up in Toronto’s Roncesvalles neighbourhood that boasts full concierge services, heated bathroom floors and a gym — co-owned by HDIs Director/lawyer Aaron Detlor and HDI/2438543 Ontario Inc.

Since 2015, HDI President Brian Doolittle and Detlor have spent $9,555,000 on purchasing land in Ontario for HDI/2438543 Ontario Inc. and paying provincial and municipal taxes on those properties.

Land Transactions from 2015-2017

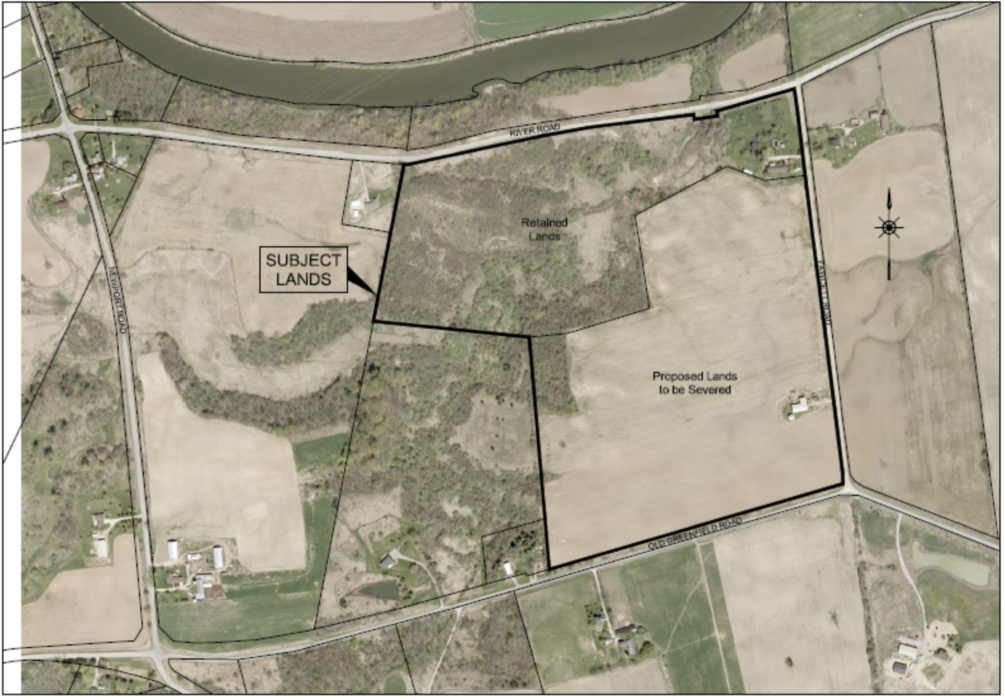

Off-reserve lands were first acquired by HDI/2438543 Ontario Inc. in April 2015 with the purchase of 126 Pauline Johnson Road in Brant County. The sale of those lands was $225,000 in cash, including $1975 in provincial land transfer taxes.

Months later, in November 2015, Doolittle purchased a Norfolk County property at 1594 Concession 2 in Wilsonville for $310,000 in cash — including a $3125 provincial land transfer tax.

By May 2016, Doolittle was closing a second deal with the same folks who sold them the Wilsonville property — this time on a much larger property located at 9 Fawcett Road in Brant County.

An initial $640,000 cash was paid for that property including $8075 in provincial land transfer taxes. A mortgage between the landowner and HDI/2438543 Ontario Inc. was secured for an additional $1.5 million with monthly instalments of $21,901.36. That loan was expected to be paid in full by 2022.

Half-truths to HCCC

While HDI/2438543 Ontario Inc. had already paid over $10,000 in provincial land transfer taxes on the Brant and Norfolk County properties — that detail was never disclosed to the public. In fact, HDI misrepresented the facts — giving only partial information about the tax situation in a HDI July 2017 Report to HCCC.

“HDI has not paid any taxes on these properties. Our auditors KPMG have provided a land tax summary for this councils information,” says the report.

The report disclosed financial statements for 2438543 Ontario Inc., claiming they ran up a total of $14,513.22 in municipal back taxes — $12,841.98 to Brant County and $1671.24 to Norfolk County. Nothing was included in the report about provincial land transfer taxes at all.

By December 2017, the subject of their off-reserve lands came back to council again. This time HDI told the council they would be paying $465,000 on November 14, 2017 to the remaining property owner of 9 Fawcett Road.

“The closing part of the mortgage Is set for November 14, 2017 and will be somewhere in the range of approximately $465,000, which will be taken from the 2438543 Ontario Inc. account,” said the report.

However land transfer documents show Doolittle paid the landowner $965,000 cash — half a million dollars more than they reported to the chiefs council that they were going to spend. It also included a payment for provincial land transfer taxes of $15,775. No details were made public in any subsequent reports to the chiefs and clan mothers about the discrepancy or the tax amounts paid in the sale of the property.

In total the Fawcett Road property totalled $3,135,000 with $23,850 in provincial land transfer taxes.

Tax arrears in Norfolk

In 2018 — Norfolk County notified HDI/2438543 Ontario Inc. of $7100.01 in tax arrears on December 31, 2018 for the Wilsonville property and said that if the arrears were not paid in one calendar year that the property would qualify for tax sale. By November 2019, the property was put up for tax sale.

In late July 2021, HDI went into full PR mode — dog whistling to their supporters through a series of press releases and interviews with local media about the situation.

Detlor spoke to reporters from the Hamilton Spectator, claiming Haudenosaunee people were using the property every day — hunting, harvesting and planting — and that they would not give up ownership of the Wilsonville property.

Skyler Williams, who at that time was celebrating a full year as acting spokesperson for Land Back Lane at the former McKenzie Meadows housing development site in Caledonia, issued a statement saying, “…we are going to take all peaceful steps necessary to protect the land and ensure that no one other than the Haudenosaunee are ever able to use this land.”

By October 2021, a notice was placed in local newspapers saying, “Prospective purchasers are hereby notified that the HCCC will not allow any non-Haudenosaunee use, occupation, or possession of the subject property and will take all necessary steps to protect Haudenosaunee use, occupation and possession.”

The Simcoe Reformer reported the property had accumulated more than $30,000 in tax arrears. Detlor told the Reformer, “It’s going to keep happening daily. We’re not going to stop the process of peacefully reacquiring lands,” he said. “And we’re certainly not going to be paying taxes on those lands to any foreign governments.”

Haldimand County taxes

Six months earlier, in December 2020, Doolittle paid $18,475 in provincial land transfer taxes on a $1.1 million Haldimand County house at 392 Oneida Road, just past the borderline of the Six Nations reserve. Municipal taxes on this property have been paid, with the most recent payment in November 2022.

By July 2021, Doolittle had purchased three more Haldimand County properties just passed the northwest border of the Six Nations reserve, adjacent to where the land reclamations of 2006 and Land Back Lane were.

Three locations: 51 Sixth Line, 44 Sixth Line and 518 Argyle Street South were purchased by Doolittle between June and July 2021 costing HDI/243843 Ontario Inc. a combined total of $3,385,000 — paid in cash — including $57,125 in provincial land transfer taxes. These three properties are currently in arrears for municipal taxes.

In November 2022, a fifth Haldimand County property at 386 Oneida Road was purchased by Detlor and Doolittle for $1.6 million in cash including a $24,475 provincial land tax. The municipal taxes for this property are paid up to date.

Toronto taxes

For the Howard Park condo, purchased in a 50% ownership share between HDI/2438543 Ontario Inc. and Aaron Detlor in January 2023, a total of $24,075 was paid in provincial land transfer tax and $24,075 was paid to the city of Toronto for municipal land transfer taxes.

Despite HDIs 2017 claim that they were $12,841.98 in back taxes owing in Brant County — there is no previous or current lien or tax arrears notices on any of the properties HDI owns in Brant — suggesting that either the County have overlooked the tax arrears HDI/2438543 Ontario Inc. have accumulated for the last 8 years or that the accounts are currently paid in full.

If taxes have never been paid to Brant County for the two properties owned by HDI/2438543 Ontario Inc. outstanding amounts could be approximately $226,000.